For the past week, the main headline has been Silicon Valley Bank (SVB). It went from highflyer to FDIC takeover in just a week. While there will be inquiries and post mortems that bring more details to light, two key takeaways have emerged: Resiliency is valuable and in our global economy almost all risk is contagious.

During the ultra-low interest rate environment of the pandemic, deposits at SVB grew significantly. The bank invested the cash in US government bonds. During the past year, as the Federal Reserve raised interest rates, the bonds fell in value. Then as companies started drawing down their cash balances, SVB had to sell the bonds at a loss to produce cash.

SVB’s investment position was not resilient, it was brittle. A resilient position would ride through the various scenario outcomes. Not all scenarios will be profitable, but a resilient position will never lead to corporate demise. The US Treasury and Federal Reserve quickly announced a plan to stabilize SVB because its risk was contagious. Payrolls throughout California and beyond would have been missed. Entire tech ecosystems would have been frozen. See this great summary from Crunchbase for more details.

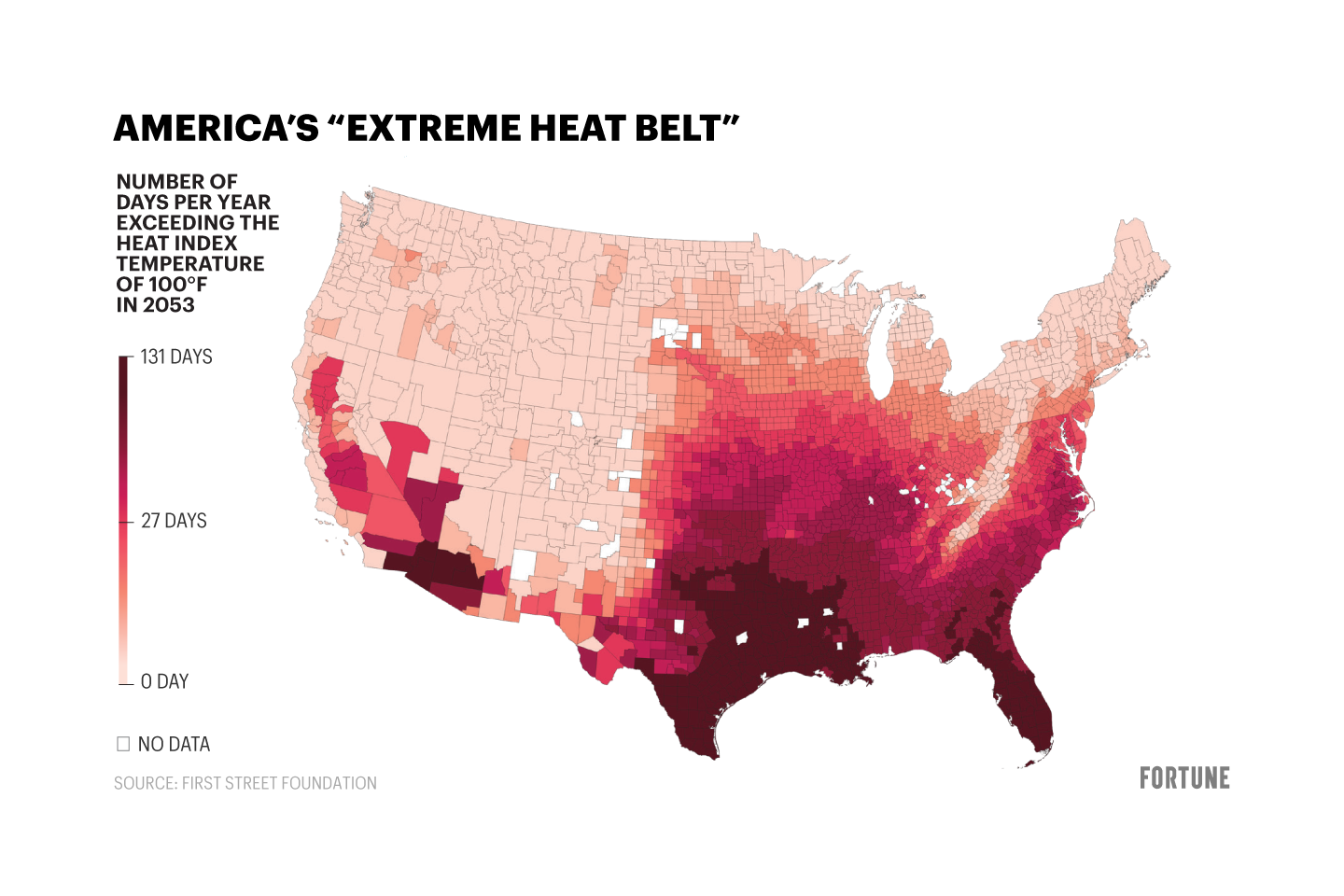

Climate risk is increasing, and it is geographically concentrated. In the next 30 years the Pacific Northwest might be remarkably unchanged, while the Southeast of the US becomes an “extreme heat zone.”

Source: Fortune

A business in Minneapolis or Seattle may feel safe. But if they get goods from the port of Los Angeles, ship product to Houston, or trade with Latin America through Miami, they are actually vulnerable to the same climate risk. Climate risk is contagious.

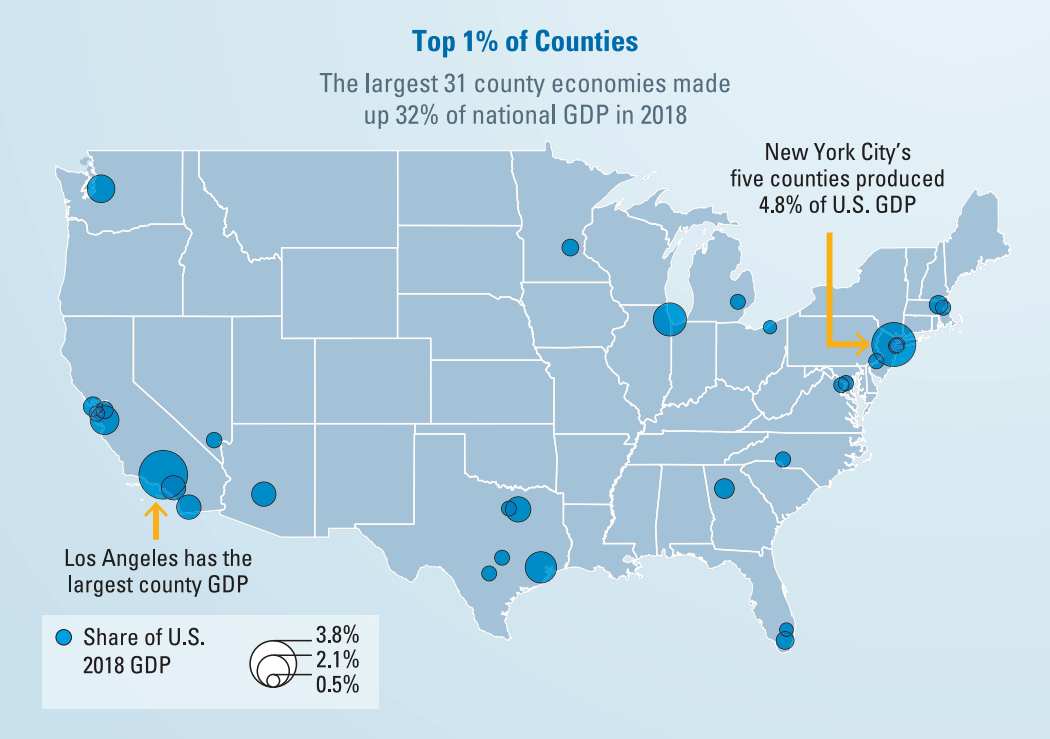

And these risks extend from events (such as a heat wave, hurricane or wildfire), to infrastructure stress and cost increases (road maintenance, electric grid upgrades, facilities upgrades) and to macroeconomic risk. For example, what if Los Angeles is essentially shut down due to extreme heat and wildfires? What if their water treatment plants go down? How much of the rest of the US is hit by an economic shock too?

The increasing size of the climate risks, their huge impact on key counties, and the correlation of costs across supply chains and the U.S. economy create significant concentrated vulnerabilities. Without measuring and managing company-specific climate risk, no Chief Financial Officer or Chief Risk Officer can determine if their business has a brittle or resilient strategy for climate risk scenarios. And because of the contagious nature of these extreme risk events, the US government will be asked to play a role again and again. Eventually it will exhaust funds and won’t be able to respond.

And as we just witnessed with SVB, brittle strategies can fall apart quickly. Flying blind and ignoring climate risk could be fatal, and there may be no government assistance. Reliable data is the first step in risk management.