Last week GLYNT attended Benchmark ESG’s Impact 2022 conference, where hundreds of Benchmark ESG users came together to hear about best practices, new product developments and insights from thought leaders. Thanks to the Benchmark ESG team for hosting a wonderful event!

Here are the two key takeaways we gained from the conference:

#1: Spreadsheets Won’t Do

Investors and experts have reached their frustration point with unverified emissions data. They look across a company’s financial statements to see the allocation of spend to emissions reductions. They line that up with reported emissions and reduction plans. They are triangulating data and have no patience for Scope 1 and Scope 2 data prepared on spreadsheets in an ad hoc manner.

If you choose to continue with hand-crafted data, be prepared for the penalty:

- Revenue hits as customers can’t use your data in their reports, so they can’t buy your product or services

- Valuation hits as ⅓ of the capital market moves away from your stock

- Acquisition opportunities lost as PE and other portfolios have to report your emissions data too

- Lack of access to loans. Bank regulators are establishing emissions reporting requirements, and this will make emissions reporting a must-have for every loan.

#2: Company-Specific Data is Far More Valuable

ESG reporting has come on us all very fast, so many companies use estimation methods to complete their Scope 1 and Scope 2 data sets. The key insight is that investors don’t find value in industry averages. They are looking for company-specific actual data. Behind the scenes they are rating your data quality by the amount that is company-specific.

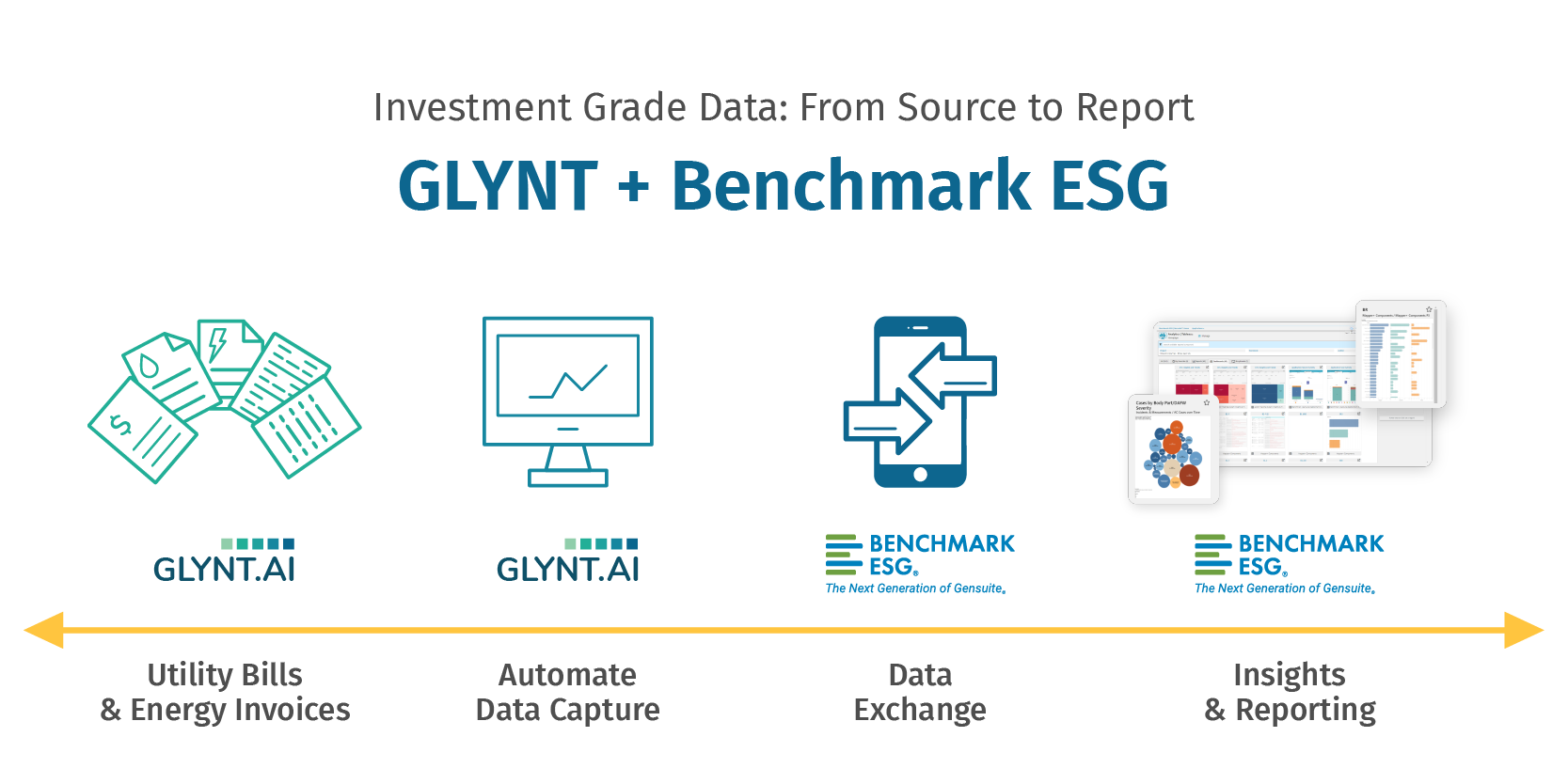

And this is where the GLYNT <> Benchmark ESG partnership is helpful. Use the combined GLYNT + Benchmark ESG solution to deliver investor-grade Scope 1 and Scope 2 data that stakeholders are demanding. And are ready to reward you for.