This is Part 2 in a two-part series. Our view is that March 2022 will be seen as the key month, when cleantech and digital climatech became imperatives. Gone is the nice to have. Climate solutions, and great data about emissions reductions are now a must-have.

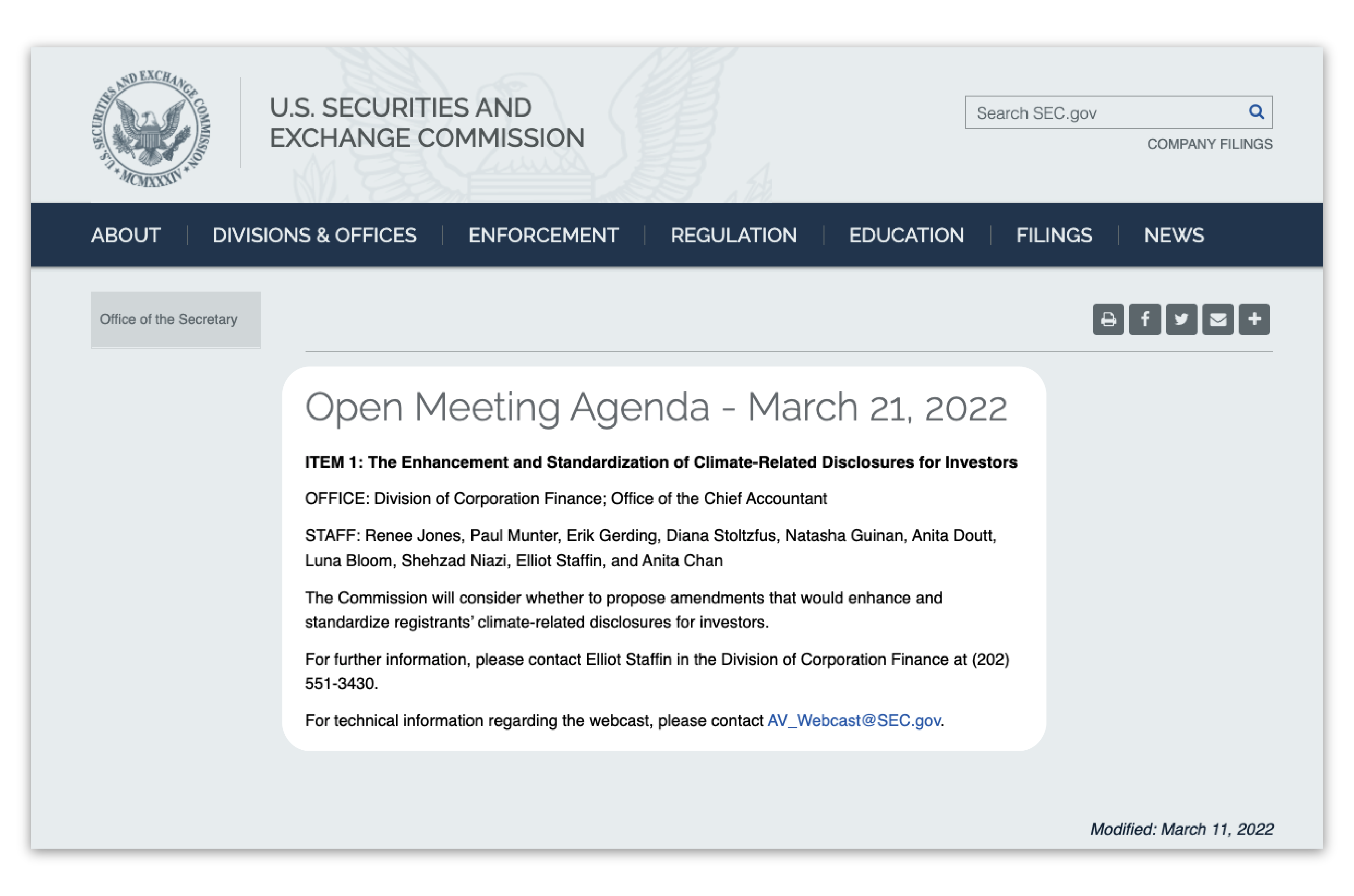

With a short brief note, last week the SEC announced, “Game On!”:

The SEC chairman, Gary Gensler, had this explanation on Twitter:

“A lot of companies are already providing such information about climate risk but investors representing literally tens of trillions of dollars are looking for more consistent and comparable information so they can make more informed decisions about where to put their money.

Why am I talking about climate risk? Simple: because investors are.

They want to know how climate-related risk will affect the companies they own. That could mean the physical risk associated with climate change or it might be the steps those companies are taking to lower risk associated with regulation or commitments to lower emissions.”

With this step by the SEC, everyone in sustainability and climatech needs high-quality reportable ESG data from primary sources. There’s no more room for guess-estimates, industry averages, and hand-crafted data.

With this move by the SEC, there is alignment between corporate risk of a faulty disclosure and the importance of high-quality ESG data to investors and the planet.

Get In Touch with GLYNT