In the past two weeks former Vice President Pence has called ESG investing a “radical agenda” and Elon Musk has called it a “scam.” Now worth $35T, ESG investing has captured more than a quarter of all financial assets under management (source). So will ESG investing go away as it becomes politicized? The answer is No, and the reasons lie in the data.

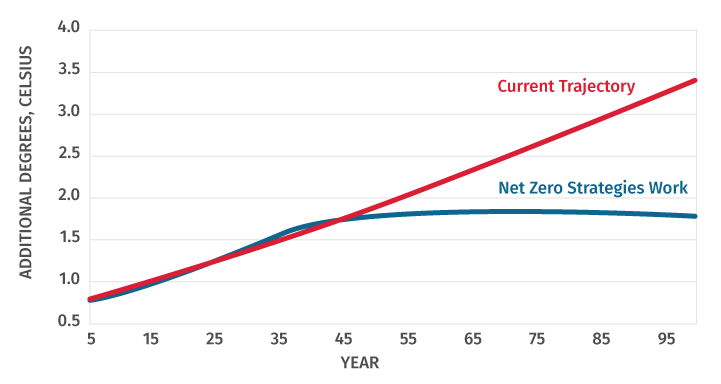

First, consider two future scenarios. Either could happen. In the first scenario, additional policies and investments decarbonize the global economy and the average temperature stabilizes. In the second scenario, our current scattered policies and investment levels continue, and the average temperature keeps rising.

Note that there is not a scenario where current policies don’t lead to temperature rise. The data is clear: this is not a valid option – it is wishful thinking.

Two Future Scenarios

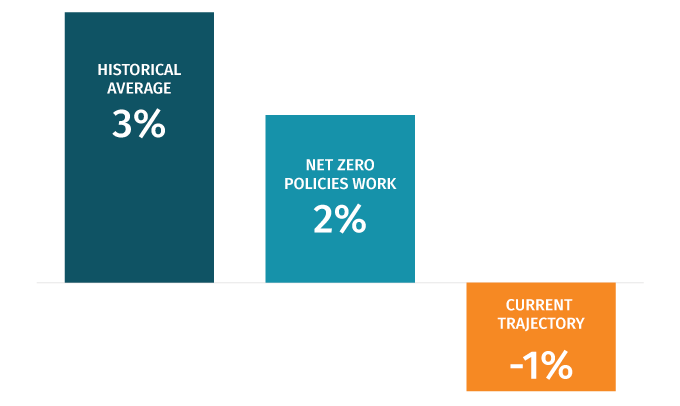

Second, take a look at the cost of each scenario. The big takeaway is that the future looks different than the past. Both future scenarios are costly – there is no escape from some kind of expense.

Comparison of Average Annual GDP Growth

None of us control policy, so acting as individual investors we can pick our scenario and plan accordingly. If we wish to believe Pence, then we would invest as if climate change did not matter to valuations.

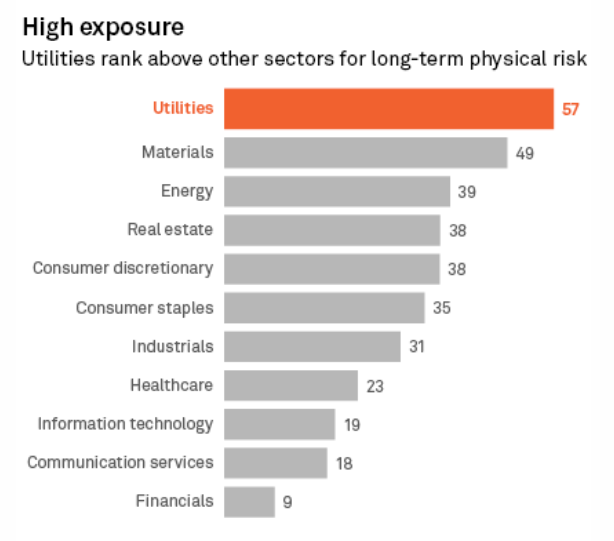

Here’s Moody’s take on which sectors could get hit the hardest by the physical risk of climate change, such as more flooding, more heat and so on. If the investment strategy is “Pence is right,” then the investor would ignore this type of analysis. But if the rest of the financial markets are using this data to price risk into stocks, the Pence investor will lose money by ignoring data that is correlated with value.

The bottom line is that climate change makes our economic future different from the past, regardless of political beliefs. Investors who ignore this substantive difference will be the losers. The climate disclosure regulations proposed by the SEC codify a lens as to how corporate valuations are affected by climate change. That lens makes money for investors, and so climate disclosures and analytics are here to stay, regardless of what some politicians and public figures say.

Get Started with GLYNT