Integrated Reporting:

Increase Data Quality, Streamline Data Preparation

Learn more about a key sustainability reporting framework, Integrated Reporting, and how you can use it to prepare more accurate and reliable data.

Introduction

Integrated Reporting is a tightly coordinated system of financial and carbon reporting, designed to give report readers a more complete and reliable view of the company. A more complete name would be Integrated Financial-Sustainability Reporting, so as to include data on water, waste, energy and emissions.

Over 175 countries around the world have adopted the IFRS reporting standards, which include a 4 – 5 year trajectory toward Integrated Reporting. For most companies, this future seems burdensome and far off. But a recent survey from Workiva shows that 97% of investors today are more likely to invest when a company reports integrated, validated sustainability data. So Integrated Reporting increases the pool of investors, an immediate win (Workiva).

Why Was Integrated Reporting Invented?

Integrated Reporting is a holistic accounting framework, intended to give investors a complete view of the financial and non-financial performance and risk of a company, and to enhance how companies strategize, plan and report these varied aspects. It was started in response to the global financial crisis of 2008 and 2009, when it was recognized that financial reports were overly focused on short-term indicators, missing longer-term value creation and risks. (1) This included the business impact of environmental and climate factors, and the first convening was facilitated by then Prince Charles, now King Charles, of England.

In the following 15 years Integrated Reporting standards emerged, and were tested by many companies. Ultimately the responsibility for standards setting was transferred to the IFRS and IASB.

In parallel, mandatory environmental reporting was required of large European companies by the EU and national governments. These standards and requirements have also evolved, and were eventually folded into the reporting standards of the IFRS. (2)

As a result, many large European companies have extensive staffing and workflows to prepare environmental data, and undertake internal and third-party audits of that data. But as these systems have been built in response to environmental regulations, they operate outside of an Integrated Reporting framework.

King Charles Speaking at A4S in 2004 (Source)

The Future: A Complete Carbon Accounting System

To move these ideas from conceptual to actionable, leading academics in accounting and policy have been laying out a double-entry carbon and environmental reporting system. Financial accounting has already studied and resolved key issues that affect sustainability reporting: how to allocate costs over time (depreciation); how to allocate costs to a product (cost accounting); and how to use double-entry bookkeeping to force data reconciliation and error removal each month. Why reinvent the wheel?

One initiative, from Bob Kaplan of Harvard Business School and Karthik Ramanna of Oxford University, extends the norms of financial accounting to carbon accounting in the global supply chain, and to carbon offsets. Learn more about the E-liability Institute

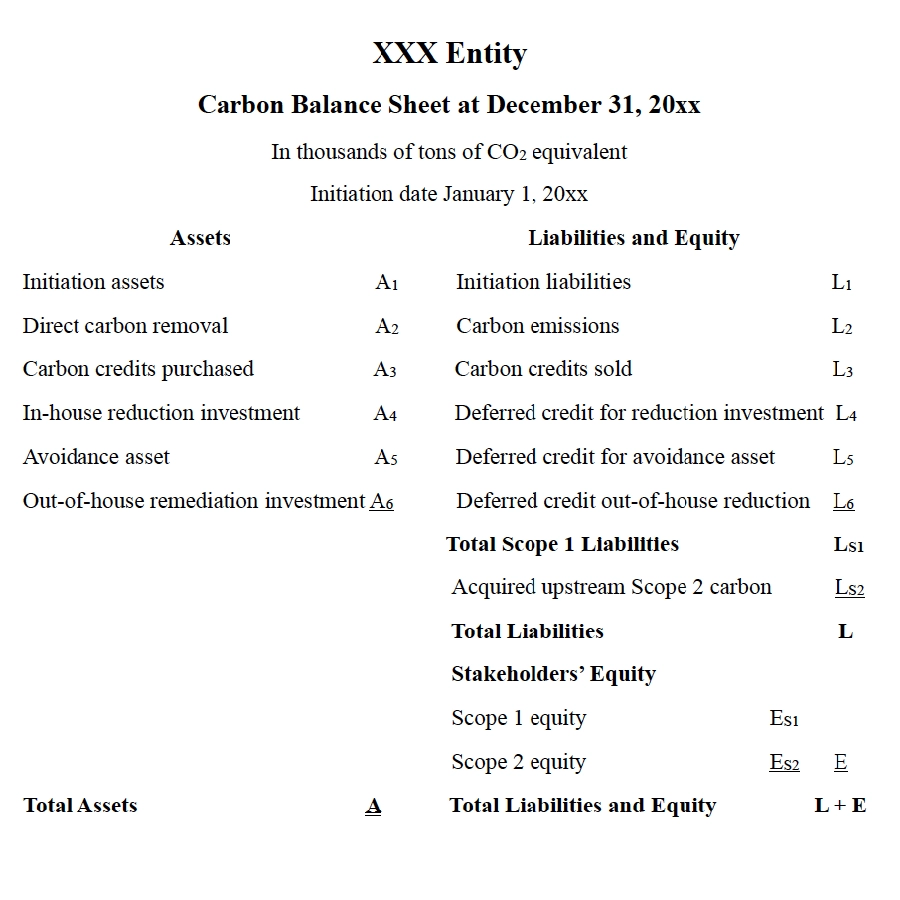

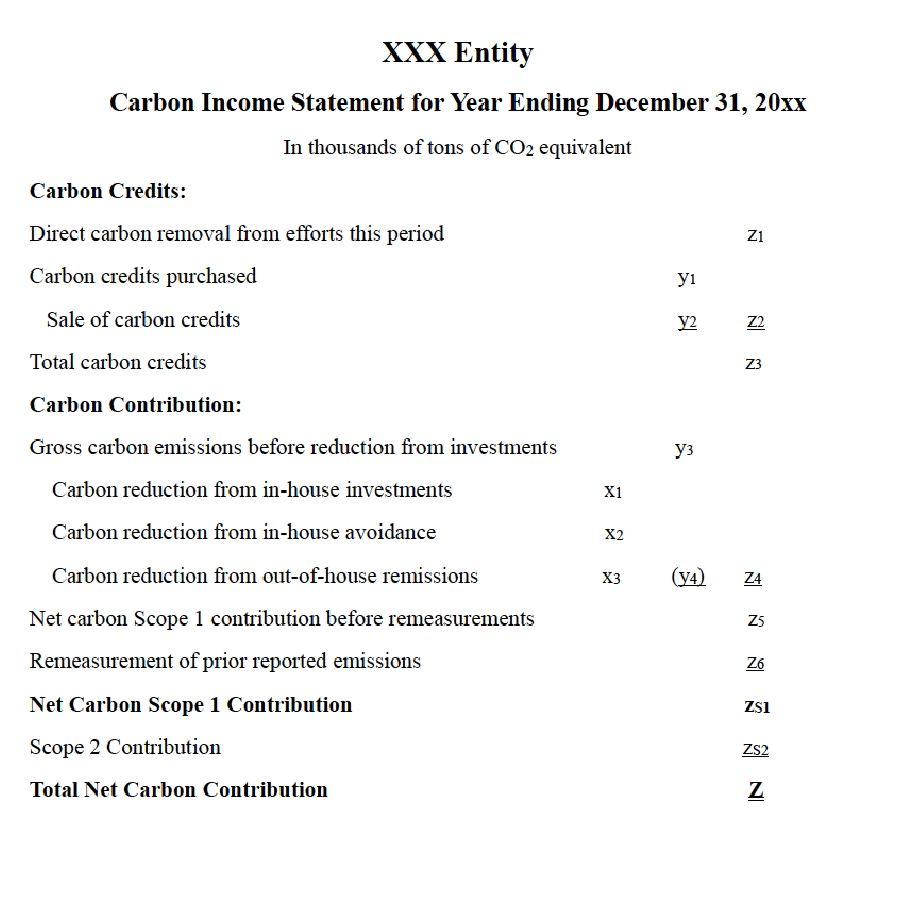

A second body of work by Stefan Reichelstein of Stanford University and the University of Mannheim has focused on preparing corporate carbon statements that mirror images of the financial balance sheet and income statements. He has also extended cost accounting methods to the calculation of product carbon footprints. In other work, Reichelstein and his co-authors have addressed the accounting requirements for multi-year carbon reduction projects. Learn more at the University of Mannheim

A third initiative is from Stephen Penman of Columbia University, who builds on Reichelstein’s work to lay out the rules and formats for carbon balance sheets and income statements. These rules can be applied to other environmental assets as well. As Penman points out, the IFRS and EU’s CSRD describe the rules for disclosures, not the full accounting system of how these disclosures are prepared. To close the gap, he provides a method to be used “if the accountant has reliable, verifiable, and auditable measures for the carbon statement elements.” (3). In other words, double-entry carbon accounting requires great data! Learn more at SSRN

THE FUTURE: DOUBLE-ENTRY CARBON ACCOUNTING & FINANCE-GRADE CARBON STATEMENTS

Source: “Accounting for Carbon,” Stephen Penman, Columbia University, SSRN

Accounting Records Connect Finance and Sustainability

While a complete carbon and environmental reporting system is on its way, it is not here yet. So without full and broadly accepted guidance, sustainability teams face a number of questions: What should be covered in a report? Which assets and data sources should be included? Which should not? How does GLYNT.AI ensure it has all the source files and has processed all the data? Some of our customers have thousands of locations, and require data preparation for several reporting years, leading to millions of data points to document and manage.

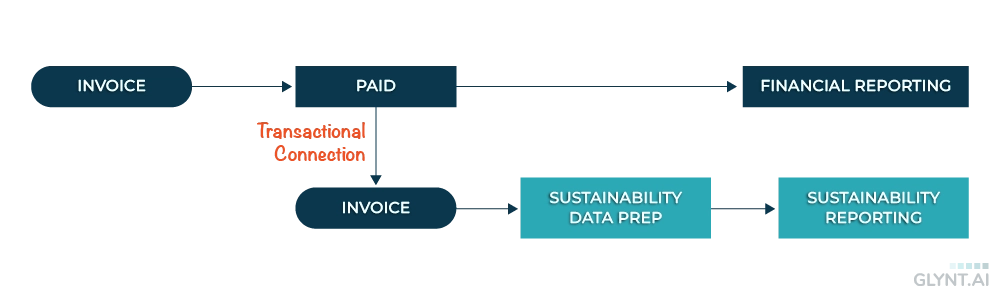

To operationalize Integrated Reporting without full guidance, GLYNT.AI has taken a “no regrets” first step, using our customer’s accounting records to establish a clear boundary of the report. We use accounting metadata to define a reference list of transactions that should be included in the sustainability report. The metadata includes master vendor lists and vendor IDs, general ledger codes and so on, which are used to establish which invoices contain raw sustainability data. This subset of invoices is tracked against the log of accounting transaction records, ensuring the entries in sustainability data sets for each accounting transaction.

The accounting transaction log is a “source of truth” and creates defensible and stable reporting boundaries. Add in GLYNT.AI’s SOC 1 testing, controls and reporting – at finance-grade levels – and Integrated Reporting is launched!

At a recent IFRS workshop, a team from SAP proposed this same solution. (4) SAP serves as the foundational ledger for a company’s operations, including accounting. Each customer can use a “transaction connection” to link the required data item in the large and detailed SAP database to a reporting element, including an element in a sustainability report.

GLYNT.AI has found that the transaction connection approach has delivered huge gains in data quality. It establishes a high-quality sustainability data set that can be used in future versions of double-entry carbon and environmental reporting.

CONNECTING ACCOUNTING AND SUSTAINABILITY RECORDS FOR INTEGRATED REPORTING

Source: “Incorporating Carbon Emissions into DecisionMaking – The Case of Transactional Connectivity,” IFRS. Graph modified by GLYNT.AI.

Using Accounting Records to Increase Data Quality and to Reduce Disclosure Risk

In practice, GLYNT.AI has found that connecting to accounting transactions makes sustainability reporting easier and more reliable.

Simplify the Search for Source Files.

Companies that have never done sustainability reporting before or that have been doing it for years benefit from the simplicity of a focus on how water, waste, energy and other relevant Scope 1 expenses are paid. GLYNT.AI works with customers to form a query of the accounting or ERP system that pulls a “blob” of files. Our AI will quickly sift and sort, identifying the relevant invoices for sustainability reporting.

For example, GLYNT.AI will find the 12 monthly invoices for location X from vendor Y. We match the transaction IDs to other file data, and verify that we have processed all the applicable files. Or perhaps vendor Y issued 13 invoices during the year, one is a correction. This common situation is now fully tracked and addressed.

Gain Consistency in Data Sets.

When sustainability teams don’t use accounting records as a source of truth and boundary setting, there are fluctuations in the amount of sustainability data produced each period. It is easy to drop a record (incomplete data) or to allow duplicate data in the system. Duplicate data is a particularly common occurrence and GLYNT.AI has seen emissions overreported by 10 – 18% from duplicate data.

The Reliability Index for Sustainability Data developed by GLYNT.AI shows that reporting accurate data is not enough. Without consistent data sets, potentially embarrassing fluctuations in baselines and KPIs are introduced. Learn more about GLYNT.AI’s Reliability Index

Materiality Tests.

Regulatory and financial reporting of sustainability is intended to be comprehensive, so that readers of the report are informed in an unbiased manner of the full picture of performance and risk. Materiality tests are a quantitative method to set the boundary of reporting, as changes in data that have a small impact on the report – below the materiality threshold can be omitted. For financial reporting the 5% rule is often used; the US SEC has proposed a 2% threshold. (5)

With the connection to accounting records, the alignment and differences in materiality can be clearly evaluated. A transaction can be financially material, and not material for sustainability. One example is backup generators on cell towers. The sum of payments for equipment and servicing may be material, while the very limited energy use is not. The opposite is more common, in that an inexpensive item has a large environmental consequence. This is often seen in supply chain (Scope 3 emissions reporting), in which a vendor with a small annual cost provides a product with a large carbon footprint. Reliance on accounting transactions aligns these materiality tests and leads to more informed decision making.

Minimize Disclosure Risk.

As mentioned above, incomplete data and duplicate data pervades sustainability reporting. This is eliminated when accounting records are used as a source of truth. In a recent article in Forbes, GLYNT.AI’s CEO laid out these ESG Disclosure Risks. One of the five noted is migration risk.

As companies update their sustainability data preparation systems, they can change the reporting boundaries. For example, improved systems may be more comprehensive, including data items not seen before. This can lead to substantial annual changes in reported emissions or environmental aspects, causing some confusion and doubt with investors and other stakeholders. Aligning with accounting records and re-producing historical reporting with the same method can quickly resolve these issues.

Make Verifiable Tradeoffs.

Every project that requires upfront investment and takes years to complete also requires a project plan and a business case. Projects that reduce energy, water, waste or emissions are no different. The cost of change and the impact of change must be measured on an apples-to-apples basis. Only when sustainability reporting is fully aligned with financial reporting at the transaction level can finance teams be assured that the full impacts are being evaluated. This moment is when sustainability goes beyond a disclosure function to a business center, and the benefit of a solid Integrated Reporting system is realized.

Validated PCFs.

Key supply chains, such as automotive, steel, pharmaceuticals and fashion, are moving quickly to sharing product carbon footprint (PCF) data with customers, so that Scope 3 emissions can be reported consistently at every level. While there are a number of companies that provide PCF calculations, and sum them up to corporate totals, without anchoring back to accounting transactions it is easy for these calculations to be different than those provided by the corporate sustainability team.

As CFOs well know, there can be only one set of numbers publicly available, and if they don’t reconcile, investor questions will ensue. Laying the foundation for PCF reporting with accounting transactions enables the principles of cost accounting to be applied to PCF calculations, as has been proposed by Prof. Reichelstein. It is only within these frameworks will the sum of emissions from products equal the sum of emissions from sites, and the corporate total.

In Sum

The goal of Integrated Reporting is a holistic view of the firm, and this is increasingly important with the rising cost and risk of climate change. The field of carbon and sustainability accounting has produced compelling reporting formats, such as the carbon balance sheet and the carbon income statement. But a powerful aspect of Integrated Reporting is often overlooked: More reliable data. Using accounting transaction records in sustainability reporting delivers higher quality data, streamlines data preparation and lays a consistent foundation for the future.

Ready to Talk with GLYNT about the Power of Integrated Reporting?

Please contact us, we’d love to hear your data story!

More Like This

The Sustainability Data Buyer’s Guide: Unlock Value with Automation

The Reliability Index for Sustainability Data

Read the Guide

The Migration Playbook

Read the Guide

Contact GLYNT.AI

New to GLYNT.AI

© 2025 GLYNT.AI, Inc. | #betterdatafortheplanet | Terms of Use | Privacy Policy | Compliance Framework