“For the first time, we are going to ensure fair treatment between our companies, which pay a carbon price in Europe, and their foreign competitors, which do not. This is a major step that will allow us to do more for the climate while protecting our companies and our jobs.”

CBAM starts on limited scale October 1, 2023 and goes into full force in 2026.

Carbon credit prices will jump. The EU’s carbon credit market has a fixed supply. Importers must buy these credits if they have high emissions. Demand will far exceed supply.

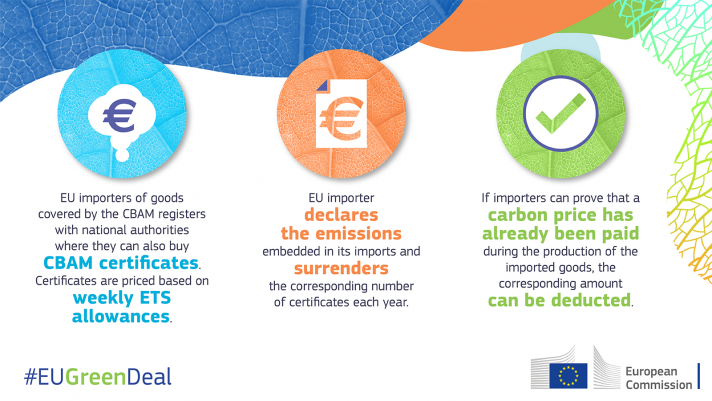

Importers must provide an audited emissions statement on their prior year emissions, and a calculation of product-level emissions intensity, which is used to set their CBAM tax level by product.

HOW CBAM WORKS

Regulators use audited emissions statements to determine the import tax

Source: European Commission

The tax amount is based total emissions in the prior year appropriately allocated to imported product.

The importer pays the tax by buying EU ETS certificates, eg the carbon credits issued by EU businesses in the EU’s cap and trade system.

While this seems like just another trade tax, it is actually different. The EU is not only protecting its own businesses, it is effectively creating policy for importers. So the regulation has global reach. And as the tax payment is tied to EU carbon credits, which can only be issued by EU companies, as the price of carbon credits skyrockets, EU companies have greater financial incentive to reduce emissions.