The Tech Stack for Sustainability Data

Definition & Overview

What is a Tech Stack for Sustainability Data?

What’s Included

The sustainability data tech stack includes all of the software and systems that are needed to capture from sources, prepare and deliver customized sustainability data to the customers’ existing or upcoming software and systems. The tech stack is more than a collection of tools, it is a complete and compliant data management system.

Why It’s Needed

The tech stack for sustainability data solves a huge challenge. Sustainability teams spend 80% of their time on data preparation, and yet nearly all ESG reporting, carbon accounting and sustainability software platforms have focused on the use of data, such as planning a decarbonization strategy, not how the data is prepared. Data preparation is left to customers (“Upload your CSV here” or “Enter your data here.”) Sustainability software apps have tried to close the gap with manual-data entry teams, or access to a collection of low-code tools. But neither of these are cost-effective when scaled to reporting from 100s of sites.

Reliable Data That Unlock Business Opportunities

Sustainability teams aim to go beyond reporting and into planning and delivering change. This requires data that supports finding, planning and delivering profitable energy savings and emissions reducing projects. Typically, these are projects are carefully reviewed and scrutinized by the finance and capital budgeting teams. Stale, coarse and estimated data fails. It takes a complete tech stack to deliver the reliable, accurate data that fits in these standard business processes. And with that data, sustainability teams can become an engine of profitable change.

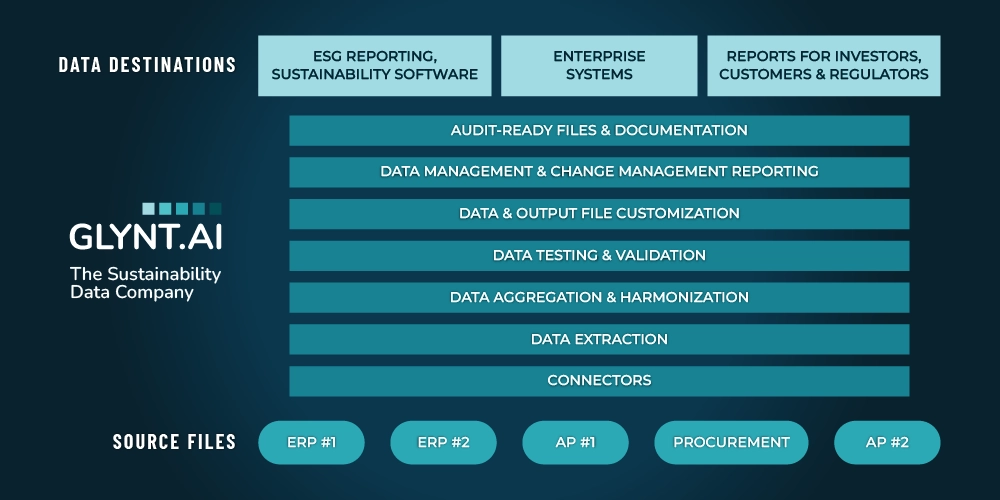

GLYNT.AI’s Tech Stack for Sustainability Data

GLYNT.AI has built a fully-featured sustainability data tech stack, which is shown in the chart below. And here’s the bottom line up front: Customers save money by leveraging GLYNT.AI’s pre-built system, as it is quite expensive to build a similar system in-house. For example, GLYNT.AI’s tech stack has a built-in customization engine, enabling seamless data flows to a host of ESG reporting and sustainability software applications. With customization options, customers also have migration options and can easily change ESG reporting and software applications by using the GLYNT.AI data system.

Finally, GLYNT.AI is SOC 1 certified, the same audited and compliant system used by public companies reporting financial data, further normalizing sustainability. Now sustainability has a tech stack like other enterprise tech, and high-quality data, just like finance.

And don’t expect the sustainability tech stack to go away. It plays a unique role in preparing accurate reliable data – a job not done by any other business system. And sustainability has too much change and requires too much domain expertise for sustainability to be an easy add-on to an existing system. As sustainability becomes part of the standard suite of corporate functions, the sustainability tech stack becomes quite common as well.

The Sustainability Data Tech Stack from GLYNT.AI

Features

Connectors

At the bottom of the sustainability tech stack are the connectors to a company’s business systems that hold invoices, utility bills, EHS reports and so on, These files contain the key data items sustainability teams need to report. GLYNT.AI’s library of pre-built connectors transfers Source Files in a secure manner and includes utility site logins. Customers often mix and match connectors, as business systems vary by locale.

If you need help in finding Source Files, ask us about our Automated Discovery Service

Data Extraction

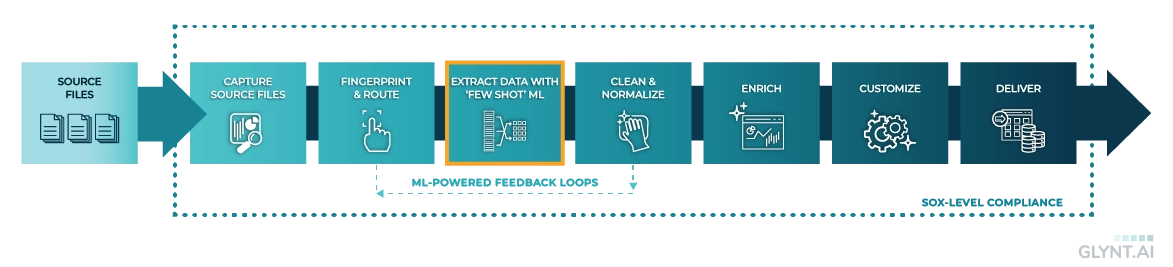

Once the source files arrive at GLYNT.AI, they are fingerprinted and routed through our machine learning (ML) system. GLYNT.AI built a proprietary ML solution, known as ‘Few Shot ML’ that allows us to rapidly customize our ML to any data source, delivering 98%+ accuracy from the start, after training on just 3 sample files. A human review closes the gap to our guaranteed 99.5% accuracy. GLYNT.AI’s purpose-built system is robust to the huge variation in incoming Source Files and their constant change.

Read more about GLYNT.AI’s ‘Few Shot’ ML

Data Aggregation & Harmonization

With such varied Source Files, the data extracted feels like apples vs oranges. GLYNT.AI developed a standardized data schema to aggregate and harmonize the extracted data, across the globe. This accounts for variations in data layouts and names, and also different energy and water billing systems, such as estimated billing with true-ups, billing in advance, and consumption-based billing. GLYNT.AI brings together years of experience, and expertise in sustainability, finance and data for a robust outcome.

Data Testing & Validation

Throughout the data preparation process, GLYNT.AI tests data in a multi-layer manner. First is a layer of data handling checks to ensure that every Source File and its contents flow through the GLYNT.AI system. Second is a test script library (100+ individual tests) that are used to check and recheck data as it is handled. Data is not sent until it passes every test. Third is a system to monitor the test system so there are no hidden failures. And fourth, we invite customers to send us their test scripts. We’ll do their data QA for them.

Data & Output File Customization

Seamless sustainability data flows rely on accurate, customized data. GLYNT.AI has a built-in customization engine and can deliver multiple output formats. Customizations include adding fields and bringing fields from other systems such as site codes, GL codes, and SAP identifiers. Enrichment and customization makes sustainability data immediately useful in procurement, FP&A, facilities management and other systems. Customization inside the tech stack eliminates the need for customers to use their own developer resources and ensures that customized data and file formats go through GLYNT.AI’s rigorous testing and validation process.

Data Management and Change Management Reporting

As sustainability teams move from annual reporting to building the business case for change, they must manage a much larger volume of data. Reporting on data handling (receipt logs, exception reports, chain of custody and so on) is key, as using consistent data sets year over year leads to much more reliable data. In a change management system is needed. Nothing stays the same in sustainability – sites change, vendors change, data sources change, data formats change – and all of this needs careful reporting. As a complete system, GLYNT.AI provides the reporting that sustainability managers, IT and finance needs to manage and verify data flows.

Audit-Ready Files & Documentation

GLYNT.AI provides a complete set of audit-ready assets that help customers streamline audits and reduce audit expense. These include data files, documentation, reporting and certifications. GLYNT.AI supports customers who setup an audit-ready archive on their systems.

Seamless Data Flows into Software & Systems

At a customer’s request, GLYNT.AI will automatically load the sustainability data prepared by GLYNT.Ai into their preferred systems. Many customers also receive CSV files, which they store separately for internal data management. As noted, there is a constant pace of change in sustainability, so a key part of the GLYNT.AI-to-software coordination includes new assets, data overwrites, and customized fields that open up audit-trail tracking.

How Does a Sustainability Tech Stack Differ From Other Technology Solutions?

The sustainability tech stack has three key points of difference with other data and software services in ESG reporting, carbon accounting, sustainability, and environmental compliance.

1. The Sustainability Data Tech Stack Is a System. As a complete system, the tech stack is more than the sum of its features. Only a complete system can lift the burden of all the tasks needed to deliver accurate, audit-ready sustainability data. Utility bill data solutions, for example, feed in one data stream, but don’t handle anything else. And as a single complete solution with GLYNT.AI’s platform costs leveraged across many customers, the tech stack for sustainability data has superior economics to a collection of point solutions or systems built in-house.

To learn more about these cost comparisons, see the GLYNT.AI TCO Calculator

2. Purpose-Built AI. At the core of the GLYNT.AI system is ‘Few Shot’ ML. Our system was built to handle the huge variation in Source Files and the constant change in sustainability data. Point solutions and ad hoc systems break in the face of these challenges, requiring internal developers and hand-keyed data to close the gaps. Purpose-built A is efficient and gets the entire job done, not just part of it.

3. Built for business customers, not their developers. With a complete data preparation system in a single tech stack, GLYNT.AI connects all the components. Customers do not need to add their developer resources to handle the missing data flows, or to validate and customize data from GLYNT.AI. Point solutions are often marketed to sustainability teams and then implemented by internal developers, raising the total costs of ownership.

Key Technologies in the GLYNT.AI Tech Stack

Purpose-Built AI

As mentioned above, GLYNT.AI built a ‘Few Shot’ machine learning (ML) system to extract data from incoming source files. Few Shot is the exact opposite of LLMs in that Few Shot needs just a 3 training samples, while LLMs need the entire internet for training data, and Few Shot uses a quickly built, highly-efficient ML model for the data source at hand, and LLMs require huge algorithms that only the richest of companies can afford to build and improve.

GLYNT.AI built our Few Shot system for rapid onboarding and low-cost operations. Then we add the steps before and after the Few Shot module in our complete data preparation pipeline.

The GLYNT.AI AI-Powered Data Pipeline

AI-First, Not AI-Assisted

There’s a natural evolution to the adoption of AI in any company. First are the experiments by data scientists, offline to production systems, and suggestive of a path forward. Then there are initial prototypes. But as no one trusts the AI, its role is limited. Third is the adoption of production-grade AI to assist and support humans. This is like a self-driving car with a human at the wheel, or using AI copilot tools to write code. The system is largely unchanged.

AI-First flips this mentality on its head. It puts humans in service of the AI, with every step in the system and every task re-thought and re-constructed, in service of higher efficiency, high accuracy and high scalability. GLYNT.AI has re-optimized our data pipeline to automatically files to feed the ML (fingerprinting and routing) and to harvest any human support into more AI-powered, automated services. The result is a constantly improving system.

AI-First goes beyond using AI as a tool, it is re-thinking the basic structure. For GLYNT.AI, it often means pushing our AI thinking to the front of the data pipeline, such as in onboarding.

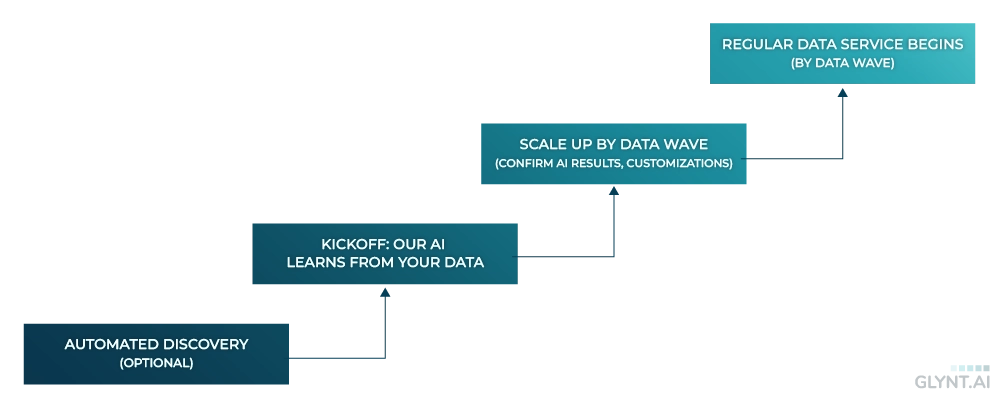

AI-Powered Migration and Onboarding

GLYNT.AI has harnessed its powerful AI to reduce the effort and cost of migrating from a current data preparation system or building a data flow from scratch.

[Note: If your company has not reported before, or wants a fresh start on sustainability data preparation, use GLYNT.AI’s Automated Discovery services. We know where to look for Source Files, and minimize the effort on your part, or that of your IT team. Our AI will sift and sort incoming files so you don’t have to.]

Migration and onboarding projects begin with a Kickoff week, in which GLYNT.AI learns from the data you’ve already prepared. Our system learns the rules your team is using, including which fields to capture, and how data is transformed and/or enriched. The Rulebook, a visual guide that keeps everyone on the same page, records all of the rules. If you haven’t prepared data before, we’ll provide you with our standard data set to get things rolling.

With rules in hand, GLYNT.AI and customers work through the remainder of the migration projects in 2-week cycles called Data Waves. Once a Data Wave is complete, it can go live with weekly, monthly or quarterly updates from those sites and vendors.

In short, GLYNT.AI uses AI to remove burdensome tasks, such as setup files, OCR template creation, low-code flow setups and so on. Focus on what humans do best, let the AI do the grunt work.

AI-Powered Migration and Onboarding from GLYNT.AI

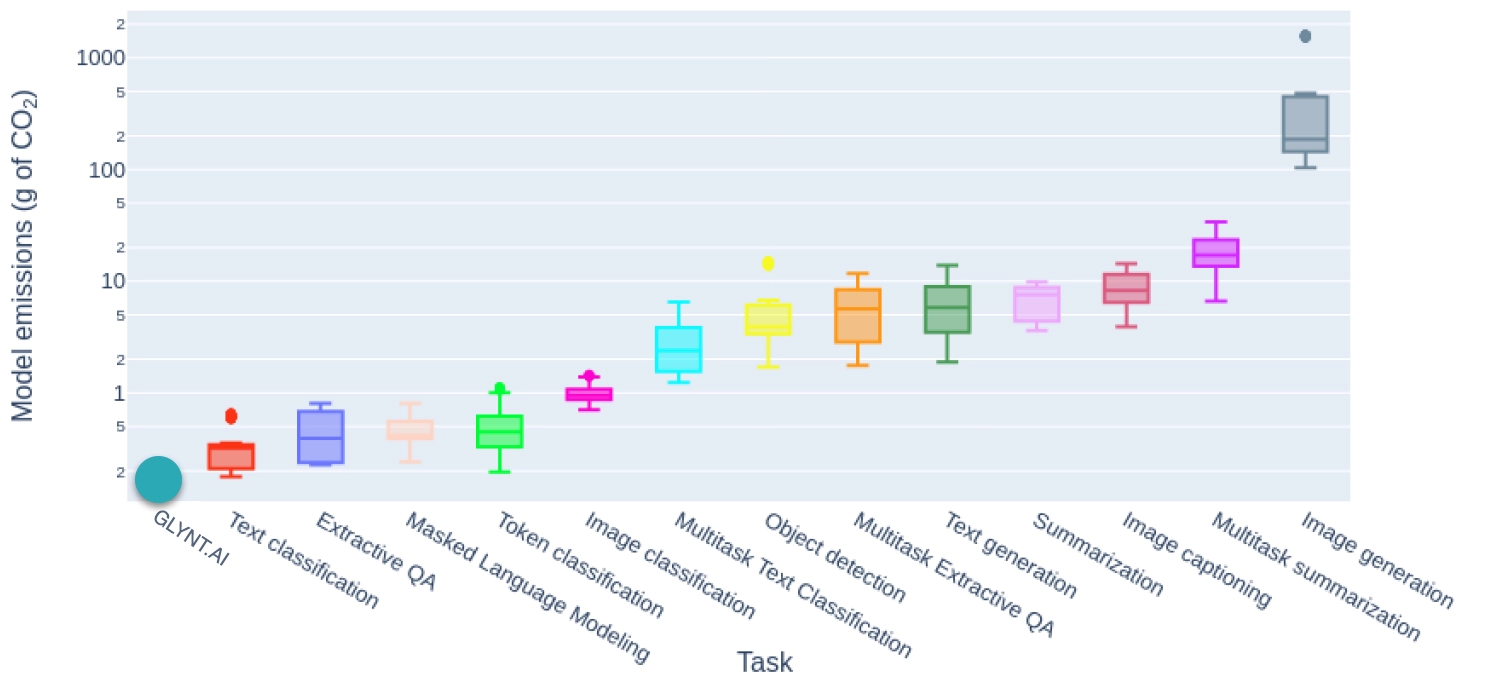

Energy & Water-Efficient AI

GLYNT.AI’s purpose-built Few Shot ML not only solves a huge sustainability data challenge – the processing of hugely varied and constantly changing Source Files – it is also energy and water efficient when compared to the energy and water consumption of LLMs for the same tasks.

Few Shot ML results uses a library of tiny, tiny training models. Each model can be trained in minutes and needs just three training samples. The model returns data at greater than 98% accuracy rates from the start and so very little retraining is needed. This hyper-efficient use of computing resources leads to energy and water usage that is less than 5% that of LLMs, and less than 20% of the emissions from standard AI tools from cloud providers for the same task.

Carbon Emissions by Task

Source: GLYNT.AI calculations; Hugging Face

Ready to Talk with GLYNT about Sustainability Data Preparation?

Please contact us, we’d love to hear your data story!

A Note For Partners

As a complete tech stack for sustainability data, it is easy to meet customer needs with GLYNT.AI.

A Sustainability Data Service in a Box. On one side of the box are the business systems that hold the Source Files. With experience and expertise, GLYNT.AI will work with the customer to get these flows going. On the other side of the box is the prepared data flowing into additional systems. Solution integrators will find GLYNT.AI’s interfaces easy to navigate. Within the box is the complete tech stack that enables GLYNT.AI to deliver accurate, audit-ready sustainability data from cost-effectively and compliant system.

Managed Services. Some partners and solution integrators use GLYNT.AI data in a managed services offering. GLYNT.AI really shines in this use case. With a highly efficient platform that has costs leveraged across many customers, GLYNT.AI is a speedy and cost-effective data service for a managed services offering.

Integrate Trusted Data Reports. Finally, partners and solution integrators can increase the value of their offering by incorporating some or all of GLYNT.AI’s Trusted Data Reports. Customers want one place to go for all of their sustainability data and reporting needs; GLYNT.AI’s library of reports is built for partner adoption and integration.

More Like This

The Reliability Index for Sustainability Data

The Reliability Index provides a simple quantitative overview of what to expect from any method or system that is used to prepare sustainability data.

Read the Guide

The Sustainable Way to Prepare Sustainability Data

Read the Guide

The Migration Playbook

This Guide shows how GLYNT.AI takes the pain and risk out of migrating to an automated data service, or onboarding with GLYNT.AI Get first data in days.

Read the Guide

The Sustainability Data Buyer’s Guide: Unlock Value with Automation

Read the Guide

Contact GLYNT.AI

New to GLYNT.AI

© 2025 GLYNT.AI, Inc. | #betterdatafortheplanet | Terms of Use | Privacy Policy | Compliance Framework