Across the business landscape, companies and industries are engaging in a digital transformation that connect capital, consumer experiences and data in new ways. One of the most dramatic examples is the technology platforms that create a simple end-to-end experience of buying or selling a home. Imagine closing a home transaction in days not months. It is astounding at how many moving parts must come together with speed, from title to escrow to funding. The iBuyer and PropTech markets are pulling together these varied services and transforming them into technology platform features. That’s disruptive speed and scale.

Missing from this fast flow is the capture of data out of documents. In the back office, when PropTech company owns a home for 90 to 120 days, there is a stream of utility bills and contractor invoices. How do you get the data out of these documents? And what about the consumer experience? Potential borrowers upload W-2s, paystubs and other common forms. How do you rapidly extract and match data for verification and loan qualification?

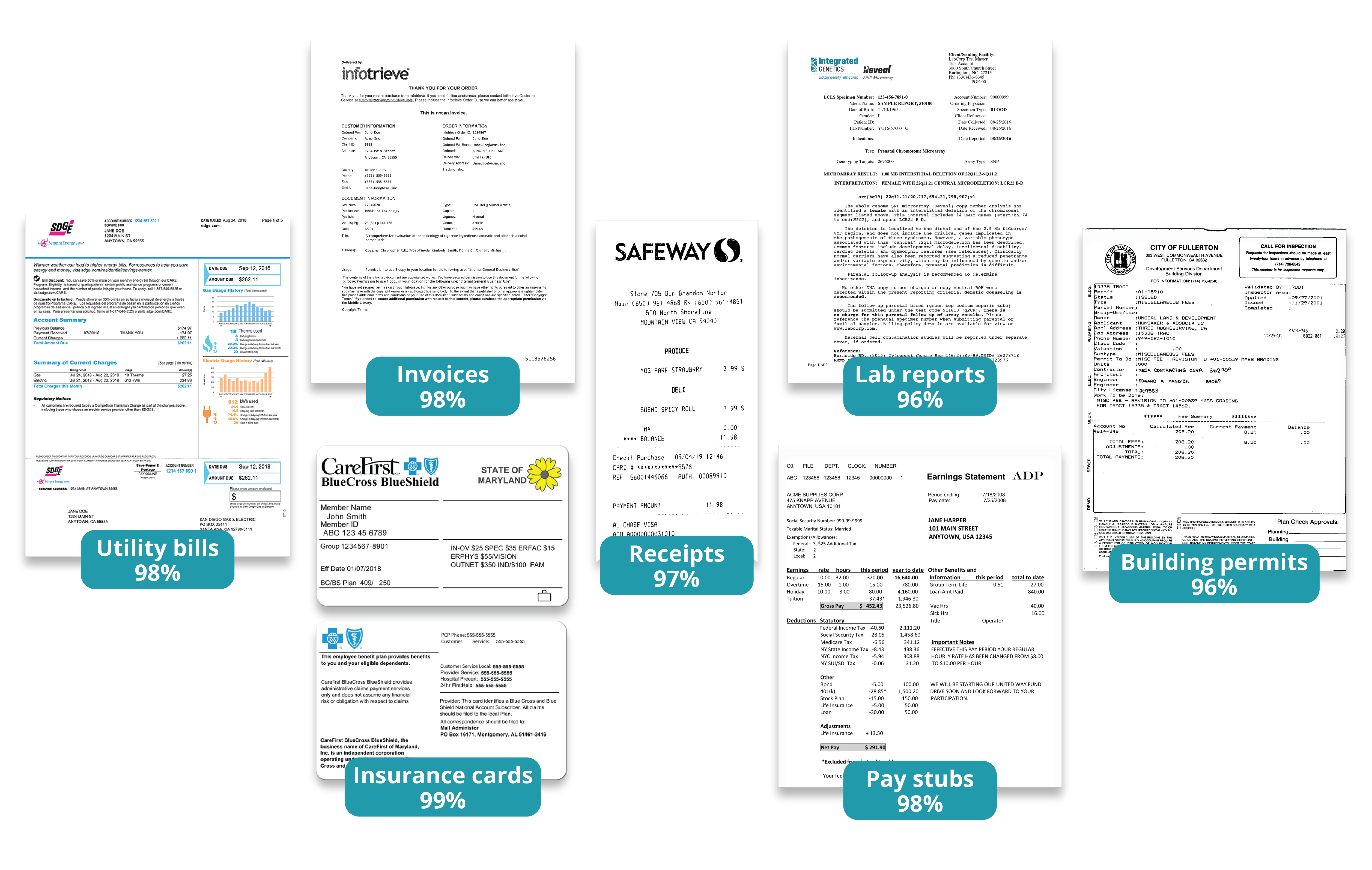

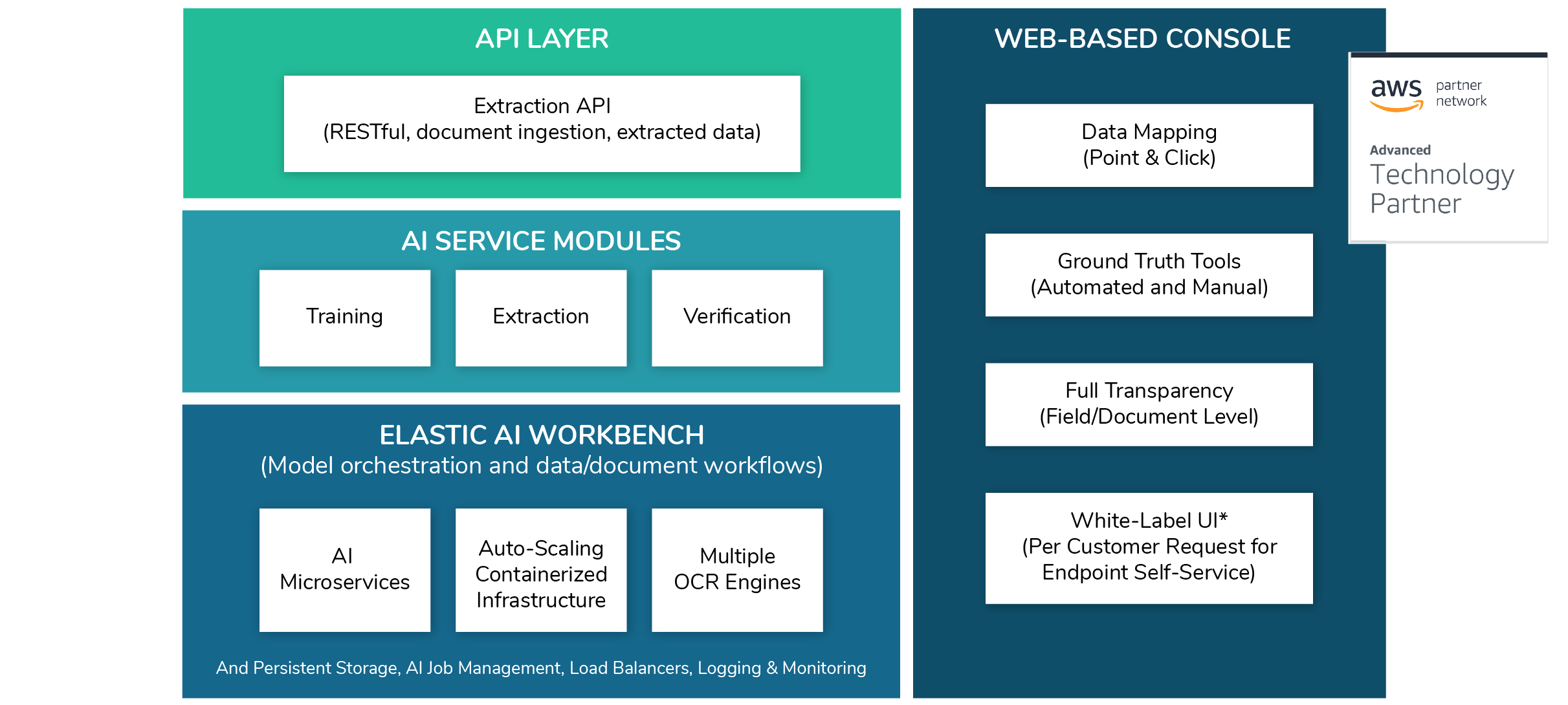

GLYNT, an advanced machine learning system that transforms documents into data, is a solution for many of the diverse types of documents processed in the iBuyer and PropTech sector. GLYNT quickly customizes the data capture to your desired fields and to your document flow, delivering an average 98% accuracy from the start. With high straight-through processing results, the need for manual review for verification and exceptions drops significantly, leading to much faster data flows and lower costs.

Here are three examples of how GLYNT speeds data flows in the PropTech sector:

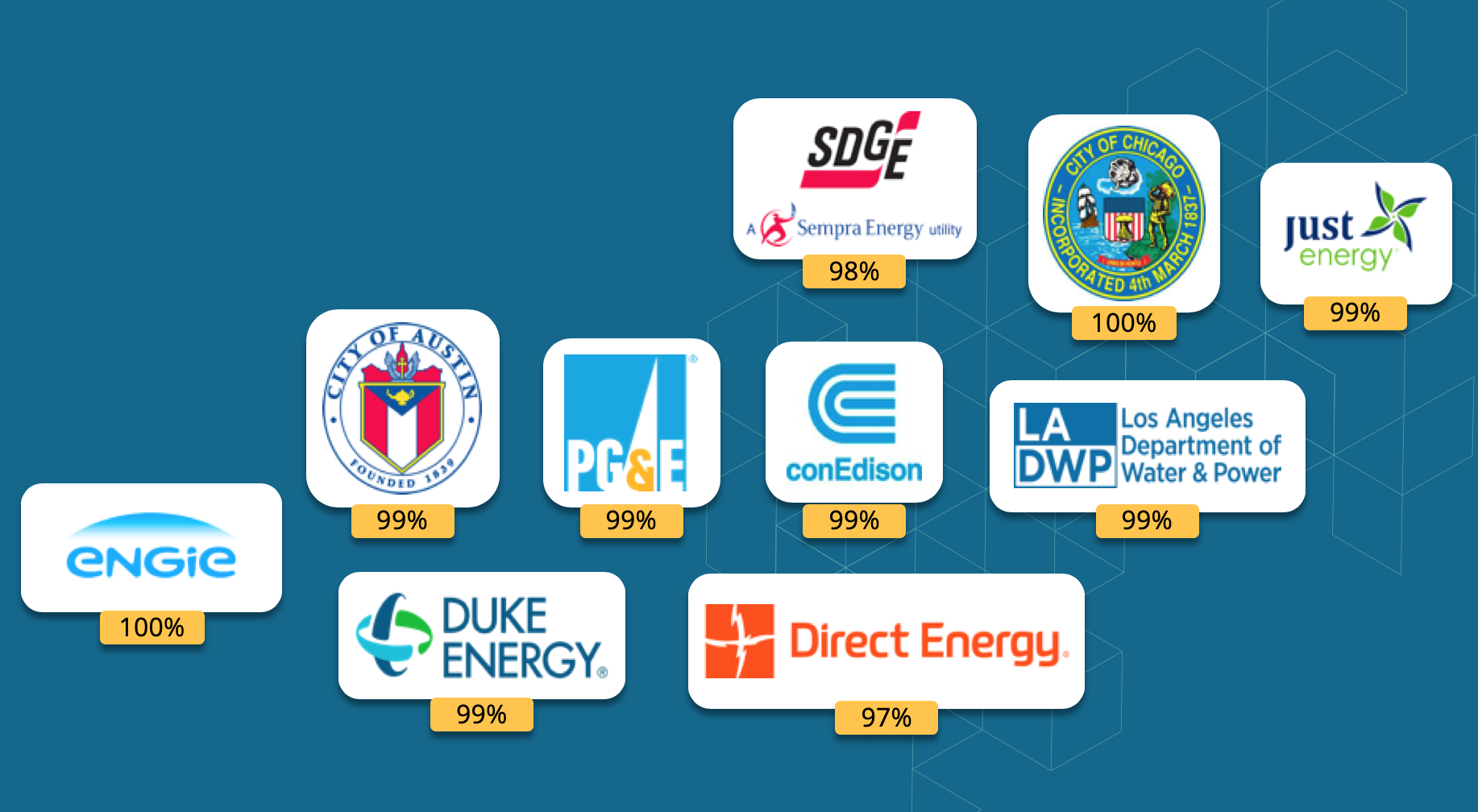

1. CONQUER UTILITY BILLS: HANDLE THESE DIVERSE AND DENSE DOCUMENTS IN EVERY CITY MARKET

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.