In a series of blog posts, S&P Global describes how they review the ESG disclosures of 17,000 companies each year, identifying data errors and working to resolve them. What caught our eye is how S&P Global is already linking financial statements and carbon disclosures, and the intense scrutiny ESG data is already under.

As S&P summarizes: “Investors and stakeholders around the world have clamored for more consistent and comparable climate-related data and disclosures.”

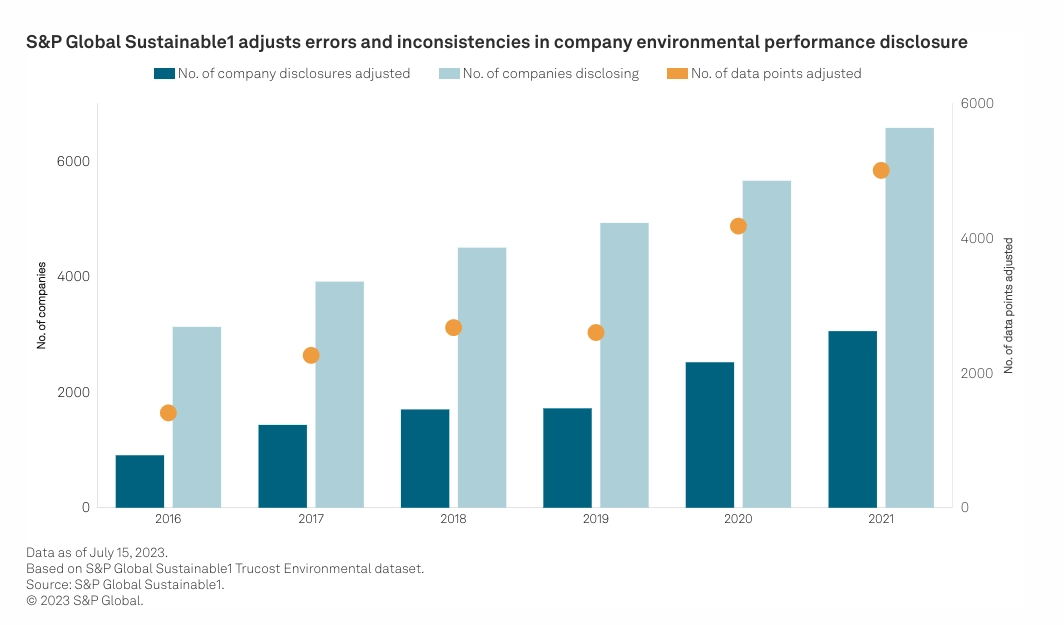

To respond to this demand, S&P has put a large data handling infrastructure in place to scrub reported ESG data for quality and consistency. Any company reporting its data – whether in an annual report or for a capital raise – should be aware of how much investment is being made in data reviews. Bad data will affect your capital raise.

Type of Data Errors Found

Source: S&P Global

As the graph shows, 47% of reporting companies make errors that are adjusted by S&P. In other work, S&P found that 70% of the errors were due to partial disclosures and 25% were due to disclosures that did not align with the GHG Protocol standards. Both of these represent “cherry picking” of results.

What makes these errors even more salient is that S&P reports that only 8% of reporting companies included any data on Scope 3 emissions. Companies are in a better position to track and reduce their Scope 1 and 2 emissions, and even these data remain quite error prone.

How S&P Fills In Data

S&P contacts companies with missing data or data quality issues, and also uses models to fill in the gaps. At the first level, the models use production volume, revenues and operating expenditures to predict emissions. Financial statements and emissions reporting become linked.

Next, industry averages are applied to fill in gaps. If you are better than your peers, report it with high quality data! Otherwise your emissions will be set at the industry average.

Further, S&P uses a data linkage service that connects the 17,000 ESG reporting companies to nearly 1 million other companies and 116 million securities (equities, bonds, and structured products). As reported data improves over time, every security will have a climate risk profile, industry averages will be calibrated and there will be no escape from the penalty of bad data.

Raising Capital? The Quality of Your Data Matters

S&P is meeting investor demands,so when reporting companies make data errors, S&P will adjust the report. To avoid the application of their estimates to your story, get investor-grade data from the start: Actual, accurate, complete and auditable.

To learn more about the high quality of GLYNT data, take a look at our White Paper, “Awesome Sustainability Data.“